Let’s check some examples of bookkeeping spreadsheet (Simple + Basic) for small businesses. In business finances, daily management of the accounting books is important to ensure the proper record and track of business income, expenses, reconciling transactions and other transactions accurately.

Whether a business is small or complex, it always involves the movement of cash in actual or digital form. Financial transactions are made for different categories such as sales, purchases, and payments.

- Make alterations in the accounts chart of the template as per business nature

- Customization of the income statement to integrate with bookkeeping

- Make a tracking sheet to keep track of invoices

- Make a forecasting sheet for calculating the projections of business cash flows.

Keeping a record of each financial transaction is a task of a bookkeeper. Also, accountants can utilize the bookkeeping for the creation of financial reports of the business.

A bookkeeping spreadsheet for a small business is a digital document or file used to record and track financial transactions and information related to the business’s income, expenses, assets, and liabilities. It is typically created using spreadsheet software like Microsoft Excel or Google Sheets.

The purpose of a bookkeeping spreadsheet is to provide a systematic and organized way to manage the financial records of a small business. It allows business owners or bookkeepers to input and categorize various financial data, such as sales revenue, costs of goods sold, operating expenses, and any other relevant financial information.

Key components of a bookkeeping spreadsheet may include:

- Income: This section records all sources of revenue for the business, such as sales, services rendered, or rental income.

- Expenses: Here, you can track and categorize all expenses incurred by the business, including supplies, rent, utilities, salaries, marketing costs, and any other expenses.

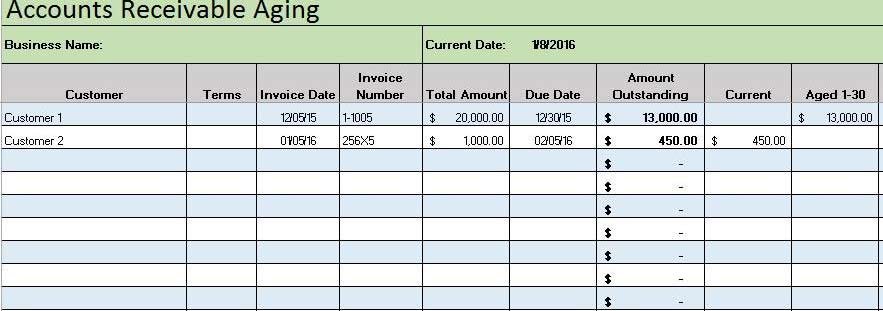

- Accounts receivable: This section helps keep track of money owed to the business by customers or clients.

- Accounts payable: It tracks the business’s outstanding debts to suppliers, vendors, or creditors.

- Cash flow: This section shows the inflow and outflow of cash in the business, indicating whether the business is generating a positive or negative cash flow.

- Assets and liabilities: It includes a record of the business’s assets, such as equipment, inventory, or property, as well as its liabilities, such as loans or outstanding payments.

- Bank reconciliation: This process involves comparing the entries in the bookkeeping spreadsheet with the bank statements to ensure they match and to identify any discrepancies.

By maintaining an accurate bookkeeping spreadsheet, small businesses can monitor their financial health, track expenses, prepare financial statements, and fulfill their tax obligations. It also provides valuable information for making informed business decisions, assessing profitability, and seeking financial assistance if needed.

In business accounting, bookkeeping is given a lot of importance for the organization, adaptation, and managing other finance-related tasks.

Bookkeeping Spreadsheet Template for Multiple Businesses

Bookkeeping is an important part of the accounting process of any business. This is a list of documents that are used to record the different types of financial transactions.

- Ultimately made via cash payment or credited into the company bank account. Major logbooks under the bookkeeping are petty cash daybook, gender ledger, supplier and customer ledger of the company.

Developed businesses prefer to employ a professional bookkeeper or to utilize expensive bookkeeping software. Small businesses totally rely on the excel spreadsheet templates of bookkeeping for recording their financial transactions day-to-day.

Features of Bookkeeping Excel spreadsheets

It is really easy to manage and setup all the daybooks related to accounting using Microsoft Excel. It’s the best alternative to expensive third-party software for bookkeeping.

These excel generated spreadsheet daybooks can easily be integrated for generating accounting sheets later.

The key features of excel generated excel bookkeeping systems.

- It helps to keep an organized list of all types of accounting sheets.

- Then enter and categorize each financial transaction, develop income statements from the bookkeeper daybooks, and track the invoices and payments against sales.

There are few limitations of excel spreadsheets such as; these can’t be integrated with bank accounts for automatically filling the transaction data, require manually generation of all the financial documents, can’t highlight data entry errors and only be accessed by a single user for any time instance.

Multiple Businesses Bookkeeping Template

There are two types of bookkeeping; one is single entry and the other is double-entry bookkeeping. The most commonly used one and the basic one is a single-entry bookkeeping spreadsheet.

- It just requires the single entry of each transaction into the different bookkeeping spreadsheets. As well as for cash inflows and outflows.

- This final transaction sheet for a specific time period is then used to generate different accounting sheets – income statements.

- These sheets then help to analyze the financial situation of the business.

- This is how having complete data on business total revenue, income, and expenses.

The double-entry bookkeeping is different in that each transaction is recorded twice. Although it’s also possible to create this type of spreadsheet in Excel it’s really complex, time-consuming, and difficult to manage.

Real Estate Bookkeeping Template

Especial real estate design template of bookkeeping in UK and Australian style. Very important to keep construction payment records and customer slips.

Salon Bookkeeping Template

Different salon business Bookkeeping templates with multiple examples can be downloaded from here. Daily to weekly base records, you can adjust through the setting section.

Trader Bookkeeping Template

Just like other business traders business financial records could also be saved through a proper bookkeeping template.

Steps to Create a Single-Entry Bookkeeping Spreadsheet for Small Businesses:

There are a few simple steps required to generate a basic single-entry bookkeeping spreadsheet for small businesses. This Excel spreadsheet will serve all the purposes that have been explained in the above sections of this article. Now let’s discuss the basic steps required to construct a bookkeeping spreadsheet in Excel;

- In the header section, write down basic details about the business, financial year, or time period.

- So the bookkeeping is and the title of the report as Small Business Bookkeeping.

- Construct a table with the number of columns, mentioning a date, and reference of the transaction.

- Description of the transaction, receipts or payment category with subcategories of income, cost, and type of payment.

- In the end, add the subtotals of income and costs columns.

- These can be subtracted to check the balance of business for a specific period of time.

There will also be a need to develop a complete bookkeeping system by following simple guidelines as. For small businesses, it’s enough to have single entry bookkeeping spreadsheets for keeping a recording of their financial transactions.