In routine life, businesses required a proper and exclusive system of cash keeping and traceable records of finances. Double-entry Bookkeeping is the general terminology used for this purpose. Using an Excel spreadsheet template, you can manage an extensive business account with such ease of access. I recently added some template of Bookkeeping spreadsheet for small businesses.

These double entry Bookkeeping templates are exclusively designed and created to help accounting experts to record transactions and financial records of the business which is used for various planning, manipulation, purchases, deals and much more. With one click search function, you can sort out any custom entry which is another included benefit.

The Double Entry Bookkeeping Excel Spreadsheet is a tool that helps individuals and businesses keep track of their financial transactions using the double-entry bookkeeping method. Double-entry bookkeeping is a standard accounting practice that records every financial transaction in at least two different accounts, ensuring that the books remain balanced.

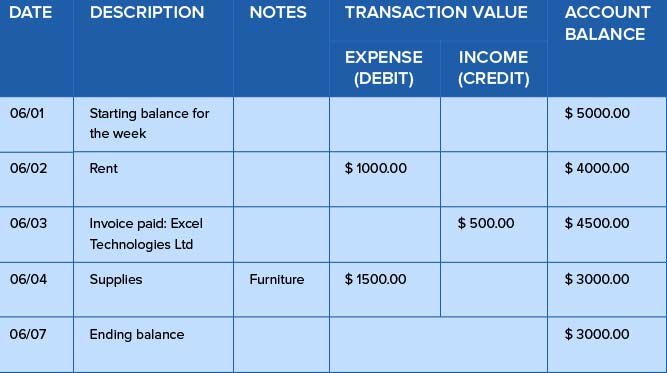

The Excel spreadsheet designed for double-entry bookkeeping provides a structured format for entering financial transactions. It typically includes columns for the date of the transaction, a description or reference, the debit amount, the credit amount, and the respective accounts affected. By recording debits and credits in separate columns, the spreadsheet facilitates the calculation of account balances and the preparation of financial statements.

The spreadsheet allows users to customize it to their specific needs by adding or modifying accounts, creating formulas for calculations, and generating reports. With the built-in functions and formulas available in Excel, users can automate various accounting tasks such as calculating totals, generating trial balances, and producing financial statements like the balance sheet and income statement.

Using a Double Entry Bookkeeping Excel Spreadsheet can provide several benefits, including accuracy in recording and balancing financial transactions, ease of organization and retrieval of data, and the ability to analyze and evaluate financial information. It can be a valuable tool for individuals, small businesses, and even larger organizations to maintain accurate and up-to-date financial records.

- Most important sheet for small business owners

- A to Z Accounts Management

- Monthly, quarterly and Annually Sheet

- Better than Expensive Accounting software

- Download Double entry bookkeeping template

It is very difficult to record business transactions and cash flows manually on paper notes. They are mostly imprecise and you have to calculate their net total yourself. It is much effective when you use a cashbook template.

You don’t have to do anything manually neither calculation. Also, you can store infinite transaction data within no time. These templates are easy to use and interpret. You can add require formulas of Excel and make your work easier.

Format of Double Entry Bookkeeping Spreadsheet

There are numerous types of entries in bookkeeping and you have to choose your mode of working to one particular format. For this very reason, you have to outline the content that you need to record and finalize the types of financial statements that you need to develop for your business accounting.

Hence there can be major or minor variations in format from business to business. However, there are some generic formatting features which one must add to this draft for professional account record keeping.

Checklist of Double Entry

We have listed a couple of such primary elements that must be a part of precise accounting record?

- Write the heading of Cashbook for business on main title position

- Draw a table with multiple columns and rows for various entries

- List down all your concerned business accounts in the first column

- Draw another column and write the nature of transaction either credit or debit

- Draw another column and write down transaction amounts in it

- In the next parallel column, write the date of transaction

- Additionally, you can add sections of date, day and mode of the transaction such as cash, cheque or pay orders.

These are some common characteristics of a standard cash book. For getting more specific template direct contact to InvoiceTemp.com team.

Another one

Great site to review. Many US College Students are needing more assistance with their written assignments than ever before. Essays Unlimited can assist with this issue.

It is useful to explain how to create a database for formulating journal entry based on accounting guide and then you can build book journal and general ledger by Excel